New and Proposed Routes 🆕

Royal Air Maroc (AT) has scheduled its new 3x weekly service from Casablanca (CMN) to Los Angeles (LAX). The route is set to bow on June 7 and will be operated by Boeing 787-8 equipment.

United Airlines (UA) will begin 3x weekly flights from San Francisco (SFO) to Adelaide, South Australia (ADL) on December 3, 2026. Look for a Boeing 787-9 on this one.

Air Algerie (AH) will begin 2x weekly service from Algiers (ALG) to Addis Ababa, Ethiopia (ADD), via N’djamena, Chad (NDJ) on April 1. This route will be operated by Boeing 737-800 equipment.

China’s Hainan Airlines (HU) will begin a 3x weekly sector from Haikou (HAK) to Hanoi, Vietnam (HAN) on December 21. This route will be operated by Boeing 737-800 equipment.

Wizz Air (W6) has added a set of three 2x weekly routes from Oradea, Romania (OMR) to its schedule: Bergamo, Italy (BGY) from March 31; Dortmund, Germany (DTM) and Rome (FCO) from June 28.

Frontier Airlines (F9) has scheduled nearly two dozen new routes for next year:

Cancun (CUN) to Chicago Midway (MDW); weekly from March 7.

Cancun to Raleigh, N.C. (RDU); weekly from March 7.

Charlotte (CLT) to Cancun; 3x weekly from March 6.

Columbus, Ohio (CMH) to Fort Lauderdale (FLL); 3x weekly from March 8.

Des Moines, Iowa (DSM) to Phoenix (PHX); 4x weekly from March 13.

Fort Lauderdale to Indianapolis (IND); 3x weekly from March 6.

Fort Lauderdale to St. Louis (STL); 2x weekly from March 13.

Fort Lauderdale to Raleigh, N.C.; 4x weekly from April 2.

Indianapolis to Las Vegas (LAS); 3x weekly from March 24.

Indianapolis to Phoenix; 4x weekly from March 24.

Indianapolis to Fort Myers, Fla. (RSW); 2x weekly from March 27.

Las Vegas to Minneapolis (MSP); 3x weekly from March 6.

Las Vegas to Memphis (MEM); 2x weekly from March 8.

Las Vegas to Milwaukee (MKE); 3x weekly from March 24.

Little Rock, Ark. (LIT) to Orlando (MCO); 2x weekly from March 15.

Memphis to Phoenix; 3x weekly from March 15.

Milwaukee to Phoenix; 2x weekly from March 26.

Nashville (BNA) to Phoenix; 4x weekly from March 6.

Norfolk, Va. (ORF) to Tampa (TPA); 2x weekly from April 3.

Omaha, Neb. (OMA) to Phoenix; 3x weekly from March 25.

Orlando to Tulsa, Okla. (TUL); 2x weekly from March 13.

Orlando to Salt Lake City (SLC); daily from April 1.

Orlando to Richmond, Va. (RIC); 2x weekly from April 2.

Winter Pricing

Final call. These prices end soon! Join now for less than 50 cents per issue.

- Monthly: $5

- Annual: $45, a 35 percent savings

- Lifetime Founding Member: $299 one time

No ads. No noise. The only aviation newsletter that brings fleets, routes, finance, and policy together in one place.

Lock in the low rate as long as you stay subscribed. Do not miss this chance.

Seasonal Routes 📆

Condor (DE) will add daily summer seasonal service next year from Berlin (BER) and Frankfurt (FRA) to Abu Dhabi (AUH). Airbus A330-900 flights from Frankfurt start on May 1, while an Airbus A320neo from Berlin gets underway on June 15. These routes are added in support of a new “strategic partnership” the two airlines signed last week.

Philippine Airlines (PR) will add a 2x weekly summer seasonal run from Manila (MNL) to Koror, Palau (ROR) on March 29. An Airbus A321 is rostered on this route.

British Airways (BA) will add 2x weekly seasonal service on the following routes:

Glasgow (GLA), Scotland to San Sebastián, Spain (EAS); July 18 through September 8

London City (LCY) to Toulon, France (TLN); May 23 through September 1

London Stansted (STN) to Olbia, Italy (OLB); May 23 through September 27

Air France (AF) will add 2x daily flights from Paris de Gaulle (CDG) to London Gatwick (LGW) on March 29. This route, last flown in 1992, will be operated by Airbus A220-300 equipment until October.

Bulgaria Air (FB) will add 2x weekly seasonal flights from Sofia (SOF) to Porto (OPO) on April 9. Service will conclude in October.

Croatia Airlines (OU) will add a pair of 2x weekly summer seasonal routes in the first week of May: Dubrovnik (DBV) to Stuttgart (STR) as well as Split (SPU) to Nantes, France (NTE).

Get your own full access subscription with route intelligence, fleet news, statistics, and more:

Upgrade to Flightline

Dropped Routes ❌

Discover Airlines (4Y) will not resume Frankfurt to Oulu, Finland (OUL) service next year.

Caribbean Airlines (BW) will end flights from Port of Spain, Trinidad and Tobago (POS) to Tortola (EIS) and San Juan, P.R. (SJU) by January 10.

Aviation Security 🛃

🇨🇦 CATSA screeners cleared 4,933,594 passengers at the 17 largest airports in Canada in November, essentially level with the same month in 2024. For the first 11 months of 2025, CATSA has seen a modest 2.2 percent annual increase in passenger traffic at these airports to 60,282,884.

Smiths Group will divest Smiths Detection to CVC Capital Partners in a $2.2 billion deal, accelerating the U.K. conglomerate’s shift toward core industrial engineering operations. Smiths Detection employs about 3,400 people and supplies screening systems for carry on, checked baggage, and air cargo at 47 of the world’s 50 busiest airports, including next generation CT scanners that allow laptops and liquids to stay in bags. The business also supports cargo, border, and urban security markets with chemical threat identification capabilities. The transaction is expected to close in the second half of 2026 pending regulatory approvals, with Smiths planning to return much of the roughly $2 billion in expected net proceeds to shareholders while investing in growth for its remaining units. CVC sees long term opportunity in aviation security demand and recurring aftermarket revenues anchored in airports worldwide.

Aviation Industry News 🗞

Airbus reported a solid month in November 2025 with 72 commercial aircraft delivered to 42 customers and 75 new gross orders recorded. Deliveries included 10 A220-300, 1 A319neo, 18 A320neo, 35 A321neo, 1 A330-800, 3 A330-900, 2 A350-900 and 2 A350-1000. Orders were headlined by 30 A350-900 for IndiGo (6E), 6 A330-900 for Etihad Airways (EY), and 8 A350F split between Silk Way West Airlines (7L) and Air China Cargo (CA). The manufacturer has reached 657 deliveries so far this year to 87 customers.

Southwest Airlines (WN) will no longer be required to pay the remaining $11 million from the penalty tied to its December 2022 winter meltdown that stranded more than two million travelers. The original enforcement action included a $35 million cash fine and about $90 million in travel vouchers for impacted passengers. The Department of Transportation said the waiver is justified because Southwest has invested more than $1 billion in systems, scheduling and operational resilience since the disruption. Regulators framed the move as being in the public interest by encouraging airlines to improve reliability rather than simply pay penalties. The other portions of the penalty remain in effect.

The Federal Aviation Administration (FAA) on December 1 alerted certain airlines that it’s investigating whether they complied with an Emergency Order mandating flight reductions at 40 high-impact airports to maintain safety during the government shutdown. The airlines are scheduled carriers that have more than 10 daily operations at any of the high-impact airports. The Nov. 12 Order stated that airlines could face fines of up to $75,000 per flight that exceeded the limits. The FAA gave the airlines 30 days to provide evidence or statements showing they complied with the Emergency Order.

In October, U.S. scheduled service airlines used 1.608 billion gallons of fuel, 6.2 percent more fuel than in September 2025 (1.514 billion gallons) and 2.0 percent more fuel than October 2024 (1.576 billion gallons). The cost per gallon of fuel in October 2025 ($2.34) was up 4 cents (1.7 percent) from September 2025 ($2.30) and up 5 cents (2.2 percent) from October 2024 ($2.29). Total October 2025 fuel expenditure ($3.77 billion) was up 8.0 percent from September 2025 ($3.49 billion) and up 4.3 percent from October 2024 ($3.61 billion).

Spirit Airlines (NK) is in the middle of a severe downsizing tied to its Chapter 11 restructuring. The carrier has already sought to reject leases on 87 Airbus A320-family jets from 16 owners, including 67 A320neos with Pratt and Whitney PW1100G-JM engines that often need expensive shop visits. Some lessors now believe those aircraft may be worth more as parts than as operational jets. Industry sources suggest that multiple part-out firms are in talks to buy unwanted A320neos, with as many as 10 scrapped in the first half of next year. Nineteen A320neos have already been torn down worldwide this year. The shift comes as Spirit shutters bases, walks away from future Airbus orders, and tries to cut costs to stay afloat in a weak US demand environment where low fares and high expenses continue to pressure the business.

IndiGo, which carries roughly 60-65 percent of India’s domestic traffic, fell into severe disruption this week as new pilot duty and rest rules took effect. The crisis began on Tuesday and continued into Friday with more than 1,000 flights canceled per day including extensive disruptions at key hubs such as Delhi (DEL), Mumbai (BOM), Bengaluru (BLR) and Hyderabad (HYD). The revised regulations increased required weekly rest from 36-48 hours and cut allowable weekly night landings per pilot from six to two, and the airline admitted it misjudged crew planning under the new system. Regulators quickly intervened, with India’s Directorate General of Civil Aviation pausing parts of the rules to improve operational recovery, while the Ministry of Civil Aviation activated a 24-hour control center and helplines. IndiGo’s chief executive pledged a reset of operations and expects full normalization no later than December 15. Passenger chaos has spread across major airports and IndiGo’s public reputation has taken a hit, with the airline’s share price falling more than seven percent over four days. The airline is India’s largest, with some 2,300 flights each day.

Finnair (AY) flew 893,200 passengers in November, a minimal drop of a half percent from one year ago. System-wide load factor for the month was 74 percent, with nearly 86 percent of all flights arriving on-time.

Mexico’s Volaris (Y4) flew 2,677,000 passengers in November, which translated into a five percent annual bump. System-wide load factor for the month was 85.3 percent, with Volaris filling just under 90 percent of its available domestic revenue seats. For the first 11 months of the year, traffic is up to 28,034,000 passengers - five percent more than 2024.

Norse Atlantic Airways (N0) delivered another strong month in November 2025 with a load factor of 97 percent (!), up five percentage points from a year earlier and marking its 13th straight month above 90 percent. Passenger traffic surged 31 percent year over year to 124,580 travelers across both scheduled services and ACMI charter flying. The carrier operated 234 scheduled flights and 225 ACMI missions while maintaining solid operational control, completing 96 percent of flights and improving on-time departures to 73 percent despite air traffic control and airport congestion challenges. With ongoing fleet expansion, a balanced mix of scheduled and long-term charter flying, and growing presence in Europe, Asia, and the Caribbean, Norse Atlantic continues building momentum heading into 2026.

Flybondi (FO) has unveiled a major $1.7 billion fleet expansion plan, confirming an order for 20 Airbus A220-300s and 15 Boeing 737-10s. Deliveries begin in 2027 and will support the Argentine low-cost carrier’s growth strategy by diversifying its fleet for better efficiency and network flexibility.

China Eastern Airlines (MU) has launched the world’s longest scheduled passenger route, linking Shanghai Pudong (PVG) and Buenos Aires Ezeiza (EZE) with a Boeing 777. Flight MU745 covers 12,229 miles in 25 hours and 30 minutes with a planned tech stop in Auckland (AKL) for fuel and crew changes, trimming more than four hours off typical China to South America travel times. The debut flight arrived slightly ahead of schedule on Thursday, and the move strengthens China’s direct long haul reach as airlines continue to push ultra long range operations using next generation widebodies. In a side note, one passenger set a world record by watching the entire catalogue of movies on offer during the same flight.

Here’s one for the plane spotters - AeroMexico (AM) has re-registered a pair of Boeing 737 MAX 8s. EI-GZB is now XA-OTB and EI-GZC is now XA-OTC on the Mexican civil aircraft registry.

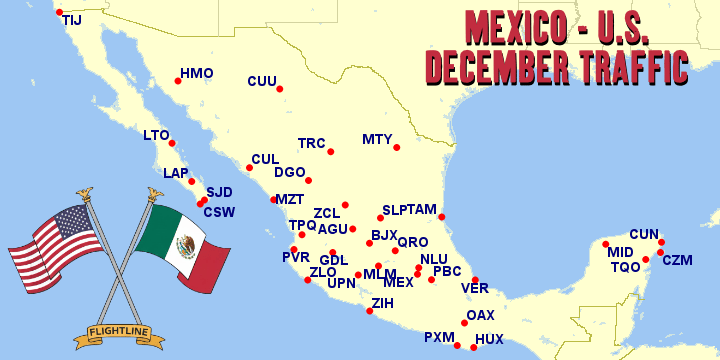

Let’s take a look at traffic from Mexico to the U.S. this December. 37 airports in Mexico have departures to 56 U.S. destinations, with a total of 2,536,409 seats available on 15,519 flights. 22 passenger airlines (a mixture of mainline and regional) offer flights, and 10 cargo airlines are also in the mix. Now, which airports in Mexico have the most seats to the U.S.? I don’t think too many people will be surprised at this list:

From Mexico to the U.S.

Cancún (CUN) 667,230

Mexico City (MEX) 487,109

Guadalajara (GDL) 377,722

Los Cabos (SJD) 262,533

Monterrey (MTY) 136,962

From the U.S. to Mexico

Dallas/Fort Worth (DFW) 297,802

Los Angeles 273,893

Houston Intercontinental (IAH) 258,069

Chicago O’Hare (ORD) 176,597

Atlanta (ATL) 108,067

Click this to Visit the World Record Spotters Logbook

Click this to Visit the World Record Spotters Logbook

Air Cargo 📦

Air cargo demand climbed five percent in November according to Xeneta, matching a five percent rise in global capacity. Load factors held steady at 63 percent while average freight rates slid five percent to $2.73 per kilogram as carriers continue to chase volume at the expense of pricing strength. Traditional shippers helped lift volumes as U.S. tariffs proved lower than feared, but e-commerce growth has flattened after two years of outsized gains. China’s cross-border e-commerce volumes were flat in October with a sharp 51 percent drop on flows to the U.S. following tighter de minimis rules. Europe is preparing similar low-value parcel reforms next year. Xeneta expects only two to three percent demand growth in 2026 with supply outpacing demand, pointing to added rate pressure and intensified market share battles among airlines and forwarders.

Latest Aircraft Deliveries 🛫

🇹🇼 B-18122, an Airbus A321-271neo, was delivered to China Airlines (CI) on December 3.

🇨🇳 B-32ND, an Airbus A321-252neo, was delivered to Air China on December 6.

🇫🇷 F-HUVT, an Airbus A350-941, was delivered to Air France on December 5.

🇨🇭 HB-JPG, an Airbus A321-271neo, was delivered to Swiss (LX) on December 5.

🇰🇷 HL8576, a Boeing 787-10, was delivered to Korean Air (KE) on December 5.

🇺🇸 N317UW, a Boeing 737 MAX 8, was delivered to American Airlines (AA) on December 5.

🇺🇸 N346BB, an Embraer ERJ-175/LR, was delivered to Envoy Air (MQ) on December 4. Painted in American Eagle livery.

🇺🇸 N784HA, a Boeing 787-9, was delivered to Hawaiian Airlines (HA) on December 6.

🇺🇸 N852ML, a Boeing 787-9, was delivered to American Airlines on December 4.

🇧🇪 OO-SBF, an Airbus A320-251neo, was delivered to Brussels Airlines (SN) on December 5.

🇵🇬 P2-PGB, an Airbus A320-300, was delivered to Air Niugini (PX) on December 5.

🇦🇺 VH-OGC, an Airbus A321-271neo XLR, was delivered to Qantas (QF) on December 4.

🇦🇺 VH-OYX, an Airbus A321-251neo, was delivered to Jetstar Airways (JQ) on December 3.

🇮🇳 VT-IOI, an Airbus A320-251neo, was delivered to IndiGo on December 5.

🇮🇳 VT-YBH, a Boeing 737 MAX 8, was delivered to Akasa Air (QP) on December 5.

Latest Aircraft Retirements 🛬

🇺🇸 N878UA, an Airbus A319-132 with United Airlines, was wfu and ferried on December 4 to Victorville, Calif. (VCV) for part-out and scrap. This frame was delivered new to China Southern Airlines (CZ) as B-2294 on January 2005. It joined United in December 2019 and had accumulated just 56,713 hours and 30,415 cycles as of October 3, 2025.

🇧🇪 OO-SSS, an Airbus A319-111 with Brussels Airlines, was wfu and ferried on December 5 to Lourdes, France (LDE) for part-out and scrap.

📈 Flightline Financials 🏦

|

Airline & Airport Operator Stock Prices (Previous Day Closing Price) |

|||

|

AAL

American $14.81 |

AERO

AeroMexico $18.28 |

ALGT

Allegiant $82.64 |

ALK

Alaska $49.65 |

|

BA

Boeing $201.89 |

CPA

Copa $118.99 |

DAL

Delta $67.10 |

EMBJ

Embraer $61.86 |

|

JBLU

JetBlue $4.79 |

LTM

LATAM $50.83 |

LUV

Southwest $37.85 |

RJET

Republic $19.30 |

|

RYAAY

Ryanair $66.10 |

SNCY

Sun Country $14.32 |

SKYW

SkyWest $103.40 |

UAL

United $104.95 |

|

ULCC

Frontier $5.17 |

VLRS

Volaris $7.47 |

OIL

Per Barrel $60.08 |

|

|

ASR

🇲🇽 Asur $301.05 |

OMAB

🇲🇽 OMA $101.76 |

PAC

🇲🇽 GAP $227.18 |

CAAP

Corp America $25.68 |

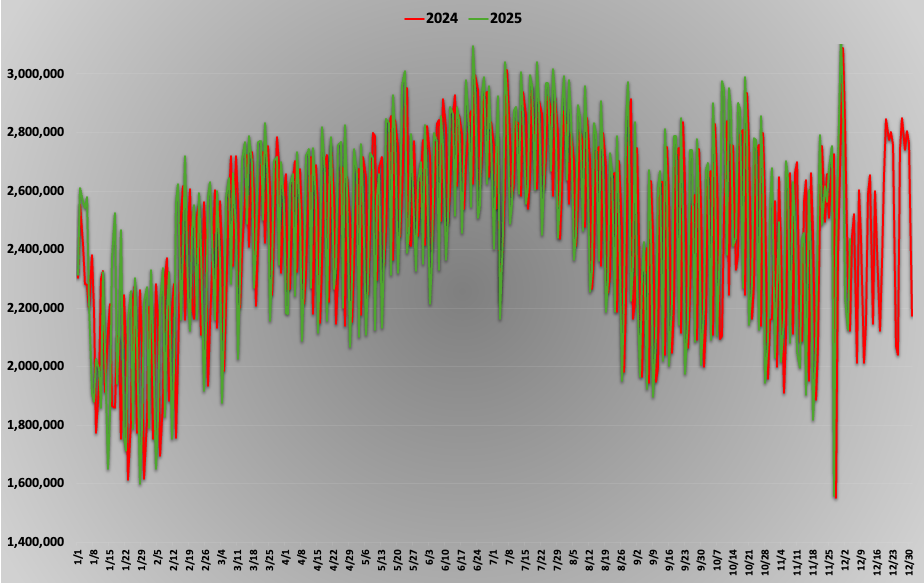

🇺🇸 Daily Passenger Counts at U.S. Airports, 2025 vs. 2024