What’s Inside this 4,900 word Flightline Brifing:

- FOR PAID SUBSCRIBERS: The Strategic Vector: Is American Airlines Losing its Seat at the Table? A detailed analysis.

- FOR PAID SUBSCRIBERS: 2025 Mexican Airport Passenger Traffic Totals.

- Porter & Air Canada Expansion: Porter resumes Nashville and Boston service, while Air Canada boosts winter capacity to Mexico, Ecuador, and India.

- U.S.–Venezuela Airspace Reopening: President Trump orders the immediate lifting of flight restrictions, paving the way for direct Miami and New York routes in 2026.

- Trade Tensions & Tariffs: A potential 50% tariff on Canadian aircraft looms as the U.S. pressures Ottawa over Gulfstream certification.

Support independent aviation journalism for less than the cost of one airport coffee!

Route Intelligence Report

Porter has also upgraded its seasonal route from Toronto Pearson (YYZ) to Liberia, Costa Rica (LIR) to a year-round service.

Air Canada (AC) will resume flights from Calgary (YYC) to Mexico this December, with two routes that were last flown in April 2023. 3x weekly service to Puerto Vallarta (PVR) starts on December 10, and 4x weekly flights to Cancun (CUN) start on December 11. Both routes will be flown by Boeing 737 MAX 8 equipment.

Air Canada is also adding 3x weekly flights from Montreal Trudeau to Quito, Ecuador (UIO) on December 4. This route sees a Boeing 787-8 rostered. Flights from Montreal to Delhi (DEL) and Lima, Peru (LIM) return on October 25. Finally, Air Canada will upgrade its seasonal service from Toronto Pearson to Copenhagen (CPH) to a year-round operation, with flights set to be flown by an Airbus A321 XLR this winter.

Our readers in Kazakhstan will be pleased at this one: Air Astana (KC) is adding 2x weekly flights from Almaty (ALA) and Astana (NQZ) to Larnaca, Cyprus (LCA) this summer. The Airbus A321neo sectors will operate from early June through early September.

Air Astana will also add a 3x weekly sector from Almaty to Shanghai Pudong (PVG) on March 29. This route will be operated by Airbus A321neo equipment.

Etihad Airways (EY) is set to begin its second Canadian route on November 3 with the launch of 4x weekly flights from Abu Dhabi (AUH) to Calgary. This route will be flown by Boeing 787-9 equipment.

All Nippon Airways (NH) will return to the Tokyo Narita (NRT) to Vancouver (YVR) sector this summer. Last flown in early 2023, All Nippon will operate a daily seasonal flight from June 5 through the end of August. This route will be flown by Boeing 787-9 equipment, and is in addition to existing flights to Vancouver from Tokyo Haneda (HND).

Scandinavian (SK) will add daily flights from Copenhagen to Dubai al Maktoum, aka Dubai World Center (DWC) on October 25. This route, the carrier’s first foray into Dubai since early 2011, will be operated by Airbus A320neo equipment.

Thai Airways (TG) intends to begin daily flights from Bangkok (BKK) to Amsterdam (AMS) on July 1. This route will be operated by Airbus A350-900 equipment. Thai last flew to Amsterdam via a tag flight from Zurich (ZRH) in 1998.

Jet2 (LS) will add 2x weekly flights from London Gatwick (LGW) to Grenoble, France (GNB) on December 13 and 3x weekly to Chambery, France (CMF) on December 21. Both routes will be operated by Airbus A321neo equipment.

Delta Air Lines (DL) will add a weekly seasonal flight from Austin, Texas (AUS) to Asheville, N.C. (AVL) on June 13, with service to conclude on September 5.

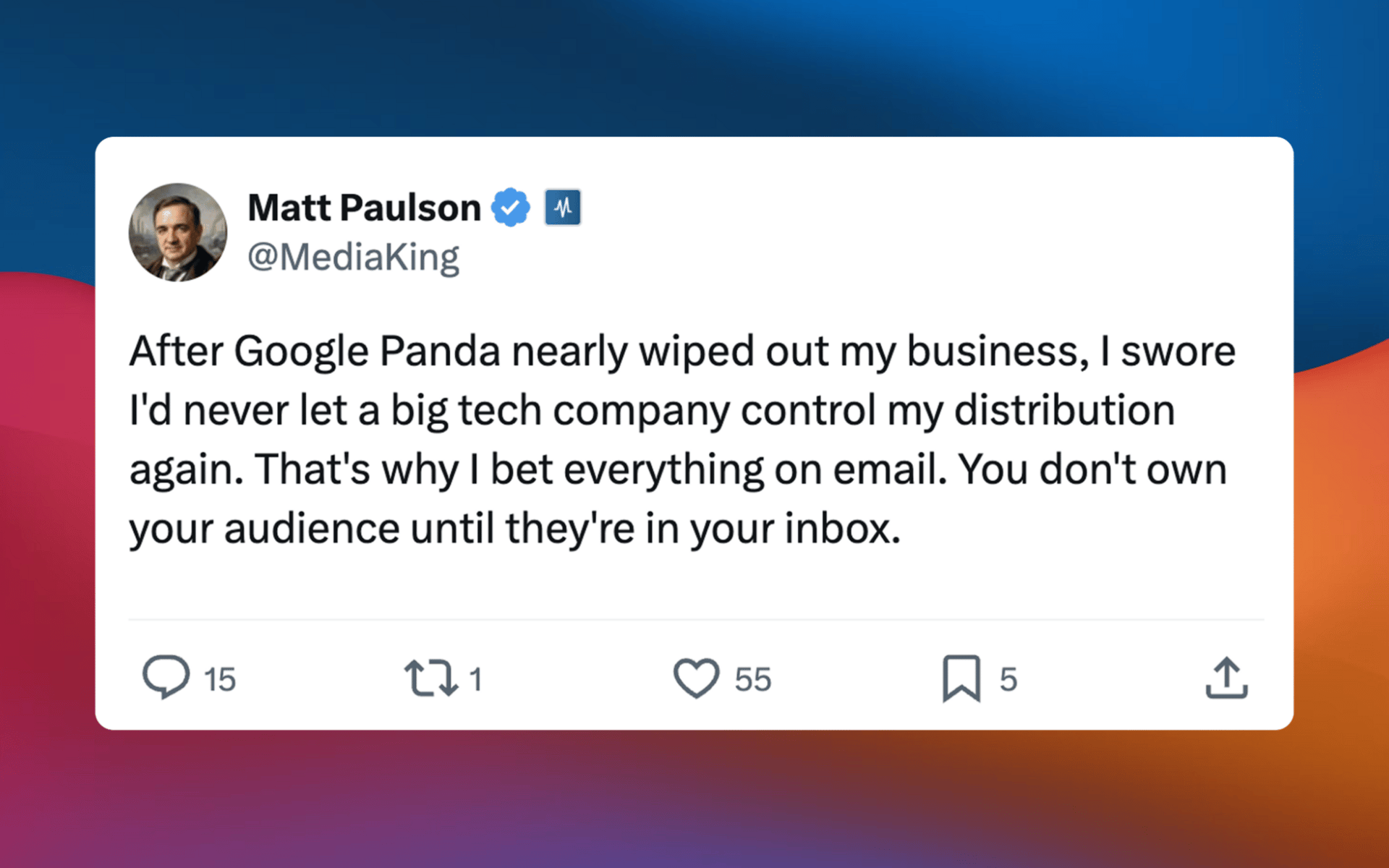

Why is everyone launching a newsletter?

Because it’s how creators turn attention into an owned audience, and an audience into a real, compounding business.

The smartest creators aren’t chasing followers. They’re building lists. And they’re building them on beehiiv, where growth, monetization, and ownership are built in from day one.

If you’re serious about turning what you know into something you own, there’s no better place to start. Find out why the fastest-growing newsletters choose beehiiv.

And for a limited time, take advantage of 30% off your first 3 months with code LIST30.

Fleet Intelligence

LATEST AIRCRAFT DELIVERIES

🇨🇳 B-228F, a Boeing 737 MAX 8, was delivered to Hainan Airlines (HU) on January 28, 2026.

🇨🇳 B-659D, a Comac ARJ21-700, was delivered to Urumqi Air (UQ) on January 28, 2026.

🇨🇦 C-FHZG, an Airbus A220-300, was delivered to Air Canada on January 28, 2026.

🇩🇪 D-ANCW, an Airbus A320neo, was delivered to Condor (DE) on January 30, 2026.

🇪🇸 EC-ORJ, a Boeing 737 MAX 8, was delivered to Air Europa (UX) on January 28, 2026.

🇮🇪 EI-XLX, an Airbus A321neo, was delivered to Aer Lingus (EI) on January 30, 2026.

🇰🇷 HL8568, a Boeing 737 MAX 8, was delivered to Jin Air (LJ) on January 28, 2026.

🇰🇷 HL8751, a Boeing 737 MAX 8, was delivered to T'Way Air (TW) on January 29, 2026.

🇹🇭 HS-VZJ, a Boeing 737 MAX 8, was delivered to VietJetAir Thailand (VZ) on January 28, 2026.

🇺🇸 N14559, an Airbus A321neo, was delivered to United Airlines on January 28, 2026.

🇺🇸 N14564, an Airbus A321neo, was delivered to United Airlines on January 31, 2026.

🇺🇸 N17429, a Boeing 737 MAX 9, was delivered to United Airlines on January 30, 2026.

🇺🇸 N563NC, a Boeing 767-3BG/ER(BCF), was delivered to Amerijet International (M6) on January 28, 2026.

🇺🇸 N77426, a Boeing 737 MAX 9, was delivered to United Airlines on January 29, 2026.

🇺🇸 N780HA, a Boeing 787-9, was delivered to Alaska Airlines (AS) on January 29, 2026.

🇺🇸 N790YX, an Embraer ERJ-175LR, was delivered to Republic Airlines (YX) on January 28, 2026. Painted in United Express livery.

🇺🇸 N97424, a Boeing 737 MAX 9, was delivered to United Airlines on January 31, 2026.

🇳🇱 PH-BKS, a Boeing 787-10, was delivered to KLM Royal Dutch Airlines (KL) on January 29, 2026. Final 787 to be delivered to KLM.

🇹🇷 TC-LPZ, an Airbus A321neo, was delivered to Turkish Airlines (TK) on January 30, 2026.

🇹🇷 TC-OHJ, a Boeing 737 MAX 8, was delivered to AJet (VF) on January 29, 2026.

🇦🇺 VH-XZT, a Boeing 737-8SA(WL), was delivered to Qantas (QF) on January 28, 2026.

🇻🇳 VN-A551, an Airbus A321neo, was delivered to VietJetAir (VJ) on January 30, 2026.

🇦🇿 VP-BAU, a Boeing 777-F, was delivered to Silk Way West Airlines (7L) on January 28, 2026.

🇮🇳 VT-IOG, an Airbus A320neo, was delivered to IndiGo (6E) on January 30, 2026.

🇷🇸 YU-ATD, an Embraer ERJ-195LR, was delivered to Air Serbia (JU) on January 29, 2026.

LATEST AIRCRAFT RETIREMENTS

🇪🇸 EC-IEF, an Airbus A320-214 with Iberia (IB), was withdrawn from use (wfu) and ferried on January 29 to St Athan, Wales (DGX) for part-out and scrap.

🇧🇷 PR-GZW, a Boeing 737-86N with Gol (G3), was wfu and ferried on January 29 to Greenwood, Miss. (GWO) for part-out and scrap.

Aviation Industry News

The International Air Transport Association (IATA) reported that global passenger demand reached record highs in 2025, with full year traffic up 5.3 percent year over year and load factors averaging a historic 83.6 percent, despite persistent capacity constraints. International demand led growth, rising 7.1 percent, while domestic markets grew a more modest 2.4 percent, reflecting a normalization after the post pandemic rebound. Airlines largely met demand by keeping aircraft in service longer and operating flights fuller, as aircraft and engine delivery delays, maintenance bottlenecks, and broader supply chain disruptions added more than $11 billion in costs industrywide. According to IATA, these conditions masked structural challenges, particularly the need to accelerate fleet renewal and sustainable aviation fuel production to support long term growth.

President Donald Trump escalated trade tensions with Canada by threatening to decertify Canadian-made aircraft and impose a 50 percent tariff on aircraft sold into the United States unless Ottawa approves certification of U.S.-made Gulfstream business jets, claiming Canada has improperly withheld approval. In a social media post, Trump said the U.S. would pull certification for Bombardier’s Global Express jets and all Canadian-built aircraft as leverage, a move industry experts say could disrupt North American aerospace relations and raises legal questions about whether the Federal Aviation Administration can revoke aircraft certifications on trade grounds. There was some chatter later that any “decertification” would only apply to newly produced aircraft; SkyWest Airlines (SWIA) flies some 240 Canadair Regional Jets (CRJs).

President Trump on Thursday ordered the immediate lifting of all U.S. flight restrictions over Venezuela. This directive to Transportation Secretary Sean Duffy and military leaders ends the FAA prohibitions on commercial traffic that had been in place since January 3, 2026, following U.S. military operations in the area. The reopening of the airspace is expected to restore direct commercial services between major U.S. gateways like Miami (MIA) and New York and Caracas (CCS), while also improving fuel efficiency for flights heading toward the Southern Cone by removing altitude and transit limitations. The FAA must still formalize the decision via NOTAMs.

Allegiant Air (G4) flew 1,616,339 scheduled passengers in December, up 4.6 percent compared with the same month in 2024. The Las Vegas based airline filled 81.2 percent of its available revenue seats across 11,586 departures, with those flights averaging a stage length of 897 miles. For all of 2025, Allegiant recorded a 10.5 percent increase in passenger traffic, carrying 18,518,653 passengers while achieving an 82 percent full year systemwide load factor. During 2025, Allegiant operated 131,668 scheduled flights with an average stage length of 893 miles.

In Q4 2025, JetBlue Airways (B6) reported operating revenue of approximately $2.2 billion and posted a net loss of about $177 million. For the full 2025 fiscal year, the airline reported a net loss of $602 million on total operating revenue of roughly $9.1 billion. That loss, however, was a nearly 24 percent improvement from the $795 million in red ink from 2024. JetBlue flew 9.718 million passengers in the last three months of 2025, filling 81.5 percent of its available revenue seats. Those passengers paid an average fare of $211.23. Jet Blue’s aircraft flew an average of 9.7 hours per day, handling 76,407 departures in the quarter. Those flights had an average stage length of 1,282 miles.

Dallas-based Southwest Airlines reported mixed fourth quarter 2025 results, with operating revenues of about $7.4 billion, representing a year over year increase but coming in slightly below consensus expectations, while adjusted earnings per share of $0.58 exceeded forecasts. The carrier posted a net profit of roughly $323 million in the quarter, supported by early contributions from new revenue initiatives such as bag and seating fees. For the full year, Southwest generated record operating revenues of approximately $28 billion, with net income of about $441 million and adjusted earnings near $512 million, surpassing prior guidance and highlighting progress in its broader business transformation efforts.

Industry Insight: 2025 Mexican Airport Passenger Totals

2025 Mexican airport passenger totals are available below.

🔒 Upgrade your subscription to see this and more data throughout the year. Thursday’s issue will cover German airports.

| Rank | City | On-Time Departures | Total Flights |

|---|---|---|---|

| 1 | Guayaquil (GYE) | 91.47% | 34,068 |

| 2 | El Salvador (SAL) | 90.28% | 47,203 |

| 3 | Rio de Janeiro (SDU) | 89.67% | 58,303 |

| 4 | Stavanger (SVG) | 89.55% | 38,894 |

| 5 | Quito (UIO) | 89.45% | 42,911 |

| 6 | Cape Town (CPT) | 88.72% | 82,030 |

| 7 | Kona (KOA) | 88.48% | 32,702 |

| 8 | Salvador (SSA) | 87.32% | 55,594 |

| 9 | Trondheim (TRD) | 86.95% | 47,291 |

| 10 | Amman (AMM) | 86.82% | 76,734 |

Air Cargo

FedEx (FX) plans to return its McDonnell Douglas MD-11 freighter fleet to service by May 31, following a months long grounding triggered by the fatal November 2025 crash of a UPS (5X)-operated MD-11 at Louisville, Ky. (SDF). The grounding stemmed from an FAA order requiring inspections after investigators found a cracked component that had been highlighted in a Boeing service advisory more than a decade earlier. FedEx said it is working closely with Boeing and the FAA to complete any required inspections and maintenance before reactivating the aircraft, signaling that it does not intend to retire the type in the near term. The move contrasts sharply with UPS, which has fully retired its MD-11 fleet and is accelerating replacement with Boeing 767 freighters, underscoring diverging fleet strategies among the two U.S. cargo giants as regulators and operators reassess the long-serving tri-jet’s future in commercial service.

IATA reported that global air cargo demand reached record volumes in 2025, with full year traffic up 3.4 percent year over year and capacity rising 3.7 percent, reflecting a return toward a more balanced supply and demand environment. Growth was driven largely by strong global e-commerce and shifts in trade flows, as shippers front loaded cargo ahead of new tariffs and redirected volumes from Asia - North America routes toward Asia - Europe and intra Asia lanes. While cargo yields declined 1.5 percent compared with 2024, the smallest drop in three years, they remain more than 37 percent above pre pandemic 2019 levels. Asia Pacific carriers posted the strongest growth, while North America was the only region to record a full year decline.

Last year Brussels, Belgium (BRU) handled 795,000 tonnes of cargo, marking an 8.5 percent overall increase and a significant 11.5 percent jump in air-only freight over 2024 Driven by expanded passenger networks and new long-haul routes, belly cargo also saw a robust 9.2 percent rise throughout 2025

Accidents

The U.S. National Transportation Safety Board (NTSB) has concluded that the January 2025 mid air collision near Washington National (DCA) that killed 67 people was entirely preventable and stemmed from systemic failures within the Federal Aviation Administration (FAA). The accident involved an American Eagle CRJ-700 and a U.S. Army UH-60 Black Hawk operating in congested airspace where helicopter routes were allowed to pass within 75 feet of commercial approach paths, relying heavily on visual separation. The NTSB cited controller workload, inadequate conflict alerting, faulty helicopter altimeters, and the failure to issue a timely safety alert as contributing factors. Investigators emphasized that a low cost $400 ADS-B In system, recommended by the NTSB since 2006 but never mandated by the FAA, could have warned both crews up to a minute before impact and potentially prevented the collision. The board issued dozens of new safety recommendations, largely directed at the FAA, and criticized the agency for failing to act on hundreds of prior recommendations, calling for a broader review of FAA safety culture and oversight practices.

📈 Flightline Financials 🏦

|

Airline & Airport Operator Stock Prices Closing Price: January 30, 2026 |

|||

|

AAL American $13.30 |

AERO AeroMexico $20.05 |

ALGT Allegiant $88.63 |

ALK Alaska $50.83 |

|

BA Boeing $233.72 |

CPA Copa $136.40 |

DAL Delta $65.89 |

EMBJ Embraer $73.46 |

|

JBLU JetBlue $4.87 |

LTM LATAM $65.81 |

LUV Southwest $47.52 |

RJET Republic $17.20 |

|

RYAAY Ryanair $70.60 |

SNCY Sun Country $17.54 |

SKYW SkyWest $96.52 |

UAL United $102.32 |

|

ULCC Frontier $4.64 |

VLRS Volaris $9.73 |

WTI OIL Per Barrel $65.21 |

|

|

ASR Asur $345.13 |

OMAB OMA $116.96 |

PAC GAP $274.91 |

CAAP Corp America $29.64 |

|

Global Currency Exchange Rates $1 USD Equals: |

|||

|

EUR Euro 0.84 |

GBP British Pound 0.73 |

MXN Mexican Peso 17.47 |

CAD Canadian Dollar 1.36 |

Enjoying This Issue?

Support Flightline and independent aviation journalism with a small contribution to help cover the costs of producing issues like this.

Thank you for being part of the Flightline community.

Daily Passenger Counts at U.S. Airports, 2026 vs. 2025

✈ A Note of Thanks

Flightline is written for readers who care deeply about commercial aviation, from routes and fleets

to security, policy, and data. Subscriber support allows this publication to remain independent,

focused, and free of advertising influence.

If you find Flightline valuable, sharing it with a colleague or fellow aviation enthusiast is the

simplest way to help it grow responsibly.

🔗 Follow Flightline

Bluesky | Instagram | Facebook | X | Flightline.news

Have a news tip to share? Send anonymously via Signal to Flightline.47

Visit the World Record Spotters Logbook

Visit the World Record Spotters Logbook