Jan

What’s Inside

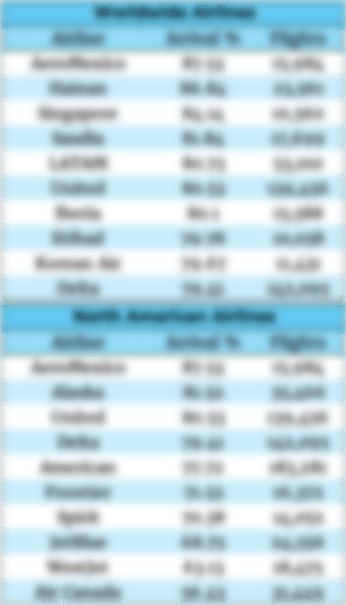

- FOR PAID SUBSCRIBERS: January 2026 On-Time Rankings: Globally and North America

- FOR PAID SUBSCRIBERS: The Strategic Shrink: A deeper look into Frontier downsizing its fleet

- Volaris adds nearly three dozen routes, while WestJet dramatically scales back U.S. service, and Frontier will shutter over a dozen stations

- Global Headwinds: Cuba faces a severe aviation fuel crisis, while American Airlines leadership faces a unanimous no-confidence vote from flight attendants

90% of aviation news is surface-level. Flightline Pro gives you the data and insider intel that helps you fly—and work—smarter.

Route Intelligence Report

EVA Air (BR) is adding 4x weekly flights from Taipei (TPE) to Washington Dulles (IAD) on June 26. This route will see a Boeing 787-9 rostered.

Icelandair (FI) will begin a 2x weekly route from Reykjavik, Iceland (KEF) to Tromsø, Norway (TOS) on October 23.

Eurowings (EW) has added a pair of routes to its network later this year: 11x weekly from Düsseldorf, Germany (DUS) to Milan Linate, Italy (LIN) from March 29, and 3x weekly from Hannover, Germany (HAJ) to Glasgow, Scotland (GLA) on June 29.

Turkish Airlines (TK) announced it will begin flights from Istanbul (IST) to Urumqi, China (URC), although start date, frequencies, and aircraft type have not yet been announced.

These are not all the routes we have to share this issue...

🔒 140 Additional New & Proposed Routes — Subscriber Exclusive

Paid subscribers get access to 140 additional new and proposed routes not shown here, including airline, frequency, start month, and market pairings.

If you rely on route intelligence for planning, analysis, or competitive awareness, this data pays for itself.

👉 Unlock full access: Upgrade to Flightline Premium

Frontier Airlines (F9) is closing 13 stations, with most set to shutter by this coming May. Rather than type them all out, please enjoy this wonderful map!

Adventure curated by the brands you trust

REI Co-op and Intrepid Travel have teamed up to take you somewhere extraordinary.

Hike Nüümü Poyo, also known as the John Muir Trail, one of America's most iconic multi-day treks, while forming lasting bonds with like-minded adventurers.

Set up camp each night with iconic backdrops and get to know your fellow travelers over dinners prepared by your local trip leader, who handles all the logistics so you can focus on the adventure.

This trip is part of a curated collection of small-group adventures across 85+ destinations worldwide. And right now, REI Co-op members save 15% on this REI Exclusive trip.

For T&Cs and more info, click here.

Fleet Intelligence

LATEST AIRCRAFT DELIVERIES

🇨🇦 C-GMJV, a Boeing 737 MAX 8, was delivered to Air Canada (AC) on February 11, 2026.

🇦🇴 D2-TAK, an Airbus A220-300, was delivered to TAAG - Linhas Aereas de Angola Airlines (DT) on February 11, 2026.

🇸🇦 EI-LKD, an Airbus A330-302(P2F), was delivered to Saudia Cargo (SV) on February 7, 2026.

🇨🇬 ET-BCI, a Boeing 737-85P(WL), was delivered to Air Congo (4H) on February 11, 2026.

🇸🇦 HZ-FBT, an Airbus A320-251neo, was delivered to flyadeal (F3) on February 9, 2026.

🇺🇸 N17430, a Boeing 737 MAX 9, was delivered to United Airlines (UA) on February 10, 2026.

🇺🇸 N435FR, an Airbus A320-271neo, was delivered to Frontier Airlines on February 11, 2026.

🇪🇬 SU-GGE, an Airbus A350-941, was delivered to Egyptair (MS) on February 9, 2026.

🇹🇷 TC-LRB, an Airbus A321-271neo, was delivered to Turkish Airlines on February 10, 2026.

🇱🇻 YL-BTC, an Airbus A220-300, was delivered to airBaltic (BT) on February 9, 2026.

LATEST AIRCRAFT RETIREMENTS

🇨🇭 HB-IJK, an Airbus A320-214 with Swiss International (LX), was withdrawn from use (wfu) and ferried on February 10, 2026 to Teruel, Spain (TEV) for part-out and scrap.

🇺🇸 N565WN, a Boeing 737-76Q with Southwest Airlines (WN), was wfu and ferried on February 9, 2026 to Coolidge, Ariz. (P08) for part-out and scrap. This frame was delivered new to China Eastern Airlines (MU) as B-2680 in June 2002. It joined Southwest in June 2014 and had accumulated 65,043 hours and 42,265 cycles as of December 26, 2025.

Aviation Industry News

Volaris (Y4) started 2026 with a 4.7 percent increase in January passengers, with Mexico’s largest airline (by passengers) welcoming 2.72 million people on board its flights. System-wide load factor for the month was just under 85 percent.

In contrast, Grupo Aeroméxico, which is of course comprised of flag carrier AeroMexico (AM) and AeroMexico Connect (5D), saw a nearly two percent drop in January traffic, finishing the month with 2.053 million passengers. System-wide load factor across both airlines was 87 percent.

The recent abrupt airspace closure at El Paso, Texas (ELP) serves as a stark reminder of the volatility in modern aviation coordination. Late on February 10, the FAA issued an unprecedented Notice to Airmen (NOTAM) classifying the area as "National Defense Airspace" and grounding all commercial, cargo, and general aviation traffic for an intended 10-day period. The closure, which caught local officials, airport management, and major carriers like Southwest Airlines and American Airlines (AA) completely off guard, was abruptly rescinded just eight hours later on the morning of February 11, after causing immediate operational chaos.

The official explanation from the Trump administration, voiced by Transportation Secretary Sean Duffy, attributed the shutdown to a "Mexican cartel drone incursion" that required swift military intervention to neutralize. However, a significant rift has emerged between this narrative and reports from industry insiders. Multiple sources, including the Associated Press, suggest the closure actually stemmed from a high-stakes disagreement between the FAA and the Pentagon. The military reportedly sought to test high-energy, laser-based counter-drone technology near Fort Bliss, but the FAA—concerned about the safety of civilian aircraft during a live laser deployment—opted to shutter the airspace entirely when a scheduled coordination meeting on the matter was bypassed by the Department of Defense.

Despite the short duration, the "ghost closure" left a tangible impact on the ground. El Paso Mayor Renard Johnson reported that critical medical evacuation flights were forced to divert 40 miles away to Las Cruces, and essential surgical equipment destined for city hospitals was delayed. FlightAware data tracked at least 14 cancellations and 13 delays during the window, while Representative Veronica Escobar and other lawmakers have called for a formal investigation into the lack of communication. As operations normalize, the incident has reignited a fierce debate over the balance between national security maneuvers and the integrity of the National Airspace System.

Industry Insight: January 2026 Airline On-Time Performance

January 2026 Airline On-Time Performance statistics are available below for paid subscribers. This issue feature worldwide and North American rankings. Monday will show Asia/Pacific and Europe, while next Thursday we share Latin American and African airline data. 🔒 Upgrade your subscription to see this and more data throughout the year.

Irish discounter Ryanair (FR) posted a modest two percent annual January gain in passengers to 12.7 million people. Ryanair filled 91 percent of available revenue seats nearly 73,000 flights during the month.

Wizz Air (W6) flew 5,348,165 passengers in January, a hefty 8.5 percent increase from the first month in 2024. Wizz had a paying passenger in 84.4 percent of its seats last month.

Posting a bit behind other airlines, EasyJet shares that it filled 89 percent of its available revenue seats in December 2025 with the help of 7.488 million passengers.

Cuba is facing acute jet fuel shortages driven by a combination of tightening international sanctions, declining domestic refining capacity, and reduced crude and fuel imports from key partners such as Venezuela, leaving the country increasingly unable to meet aviation demand. Aging infrastructure and limited access to hard currency have further constrained Havana’s ability to purchase fuel on the spot market, while logistics disruptions have periodically stranded shipments offshore. The repercussions are already visible across Cuban aviation, with airlines forced to cut frequencies, delay or cancel flights, and in some cases tanker fuel from foreign stations to avoid uplifting in Cuba. Over time, persistent fuel scarcity risks further isolating the island from international air connectivity, discouraging tourism, increasing operating costs for foreign carriers, and weakening Cuba’s broader economic recovery efforts, which remain heavily dependent on reliable air access. Air Canada has already announced a suspension of flights to Cuba.

Iberia (IB) will operate its largest-ever summer program to Latin America in 2026, offering more than 3.35 million seats between Europe and the region, up 7.6 percent year over year, with peak operations reaching 366 weekly transatlantic flights. Growth highlights include up to four daily flights to Buenos Aires (EZE) during peak weeks, the launch of a new three-times-weekly Madrid (MAD) to Monterrey (MTY) route from 2 June, a 15 percent capacity increase to Brazil, and double-digit seat growth to the Dominican Republic and Puerto Rico. Chile also sees a seven percent rise in capacity, with 12 weekly flights to Santiago (SCL). The expansion supports Iberia’s Flight Plan 2030 strategy and further cements Madrid as a leading European hub for Latin American connectivity.

Flightline has been adding several various ‘shorts’ to social media channels, an effort that we started last month. The idea is to post two or three shorts, under 20 seconds typically, each day. These will feature various factoids - passenger traffic, airline news, routes, and so on. Please feel free to visit and give us a follow!

Egyptair has taken delivery of its first Airbus A350-900, marking a major step in the carrier’s wide-body modernization program. The aircraft, registered SU-GFR, is configured with 30 Business Class and 310 Economy Class seats, and will initially be deployed on medium and long-haul routes as Egyptair begins to introduce the type into scheduled service.

Oman Air (WY) reported a strong commercial performance for 2025, carrying approximately 6 million passengers, an eight percent increase over the previous year. This growth was largely driven by a twenty-nine percent surge in traffic to Europe, supported by a thirteen percent increase in capacity and the addition of new routes to Amsterdam (AMS) and Copenhagen, alongside the resumption of double-daily service to London Heathrow (LHR). A key highlight of the year was the airline's official entry into the oneworld alliance, expanding its reach to nearly 900 airports. Additionally, the carrier saw a thirty-four percent year-on-year increase in point-to-point traffic into Oman (MCT), aligning with its transformation strategy to boost regional tourism and achieve profitability by the end of 2026. Looking ahead, Oman Air plans to launch service to Singapore (SIN) in July 2026 and is currently evaluating "higher capacity narrowbodies" to further modernize its fleet following the phase-out of its Airbus A330s.

American Airlines’ internal unrest escalated significantly this week as the Association of Professional Flight Attendants (APFA) delivered a historic unanimous no-confidence vote in CEO Robert Isom, citing a “relentless downward spiral” in leadership amid operational failures and competitive underperformance. This development follows a recent critical letter from the Allied Pilots Association, in which pilots’ leadership expressed that they have “lost confidence in management’s ability to correct course” and called on the board for decisive action, though stopping short of a formal union vote. The dual rebuke from both major frontline workgroups — one formal and one strongly worded — signals deeper governance and morale challenges, raising the stakes in ongoing labor relations and potentially complicating contract negotiations, recruitment, and operational cohesion at a time when American continues to lag key competitors operationally and financially. Even Isom’s dog has declined to express confidence, citing “ongoing walk-time reliability issues” and several recent cancellations for scheduled games of “fetch.”

Frontier Airlines has filed a lawsuit against American Airlines in a Florida district court seeking damages exceeding $100,000 following a ground collision at Miami (MIA). The incident occurred on March 7, 2024, when an American Airlines Boeing 777-300 executing an "out of compliance pushback" struck the vertical stabilizer of a parked Frontier Airbus A321neo. The impact caused significant structural damage, forcing the Frontier aircraft out of service for six months until September 4, 2024, for a full stabilizer replacement. While a partial settlement was reached in September 2025 to cover direct repair costs, this new legal action seeks compensation for lost revenue, lease payments, and operational disruptions. Frontier’s complaint alleges gross negligence and highlights a pattern of safety deficiencies, noting a similar ground collision involving the two carriers at Boston International Airport earlier in 2024.

The U.S. Department of the Treasury has issued General License 30B through Office of Foreign Assets Control (OFAC), authorizing payments and essential services at Venezuelan ports and airports, including ground handling, refueling, maintenance, and airport fees, effective February 10, 2026. The move replaces a 2021 license and partially lifts operational restrictions imposed under the 2019 Venezuela sanctions regime, creating a legal pathway for U.S. airlines to resume service to the country. American Airlines is currently the only U.S. carrier publicly expressing interest in returning to Venezuela, having been the last U.S. operator to exit the market. OFAC emphasized that transactions with blocked individuals or entities remain prohibited, but the measure is intended to normalize logistics and aviation infrastructure access without exposing carriers to sanctions violations.

A tip of the Stetson to Redditor BrilliantBig12, who compiled a list comparing the prices of a plain Grande Coffee at two dozen U.S. airport Starbucks. We took that data and made this chart, if you are looking for savings!

DID YOU KNOW? Costco sells 199 million hot dogs at its food courts each year.

The Strategic Shrink

Why Frontier Airlines is Pulling Back in 2026

For years, Frontier Airlines has been the poster child for aggressive, ultra-low-cost growth, flooding the U.S. market with cheap seats and a "buy-more-planes" mentality. However, following their Q4 2025 earnings call this week, the airline officially confirmed a dramatic pivot. In a move that may well signal the end of an era for the traditional ULCC business model, Frontier is "rightsizing" its fleet to save its bottom line.

💎 Subscriber-Only Deep Dive Below

The following section is for paid Flightline 69 subscribers. We dive into the specific reasons behind the fleet changes and the "Sale-Leaseback" math that kept the airline from a Spirit-style collapse.

📈 Flightline Financials 🏦

|

Airline & Airport Operator Stock Prices Closing Price: February 11, 2026 |

|||

|

AAL American $14.35 |

AERO AeroMexico $18.67 |

ALGT Allegiant $109.33 |

ALK Alaska $57.50 |

|

BA Boeing $236.26 |

CPA Copa $150.60 |

DAL Delta $71.42 |

EMBJ Embraer $72.44 |

|

JBLU JetBlue $5.81 |

LTM LATAM $61.37 |

LUV Southwest $51.43 |

RJET Republic $18.48 |

|

RYAAY Ryanair $65.06 |

SNCY Sun Country $20.88 |

SKYW SkyWest $104.54 |

UAL United $113.94 |

|

ULCC Frontier $5.49 |

VLRS Volaris $10.20 |

WTI OIL Per Barrel $64.89 |

|

|

ASR Asur $377.67 |

OMAB OMA $129.11 |

PAC GAP $293.95 |

CAAP Corp America $29.49 |

|

Global Currency Exchange Rates $1 USD Equals: |

|||

|

EUR Euro 0.84 |

GBP British Pound 0.73 |

MXN Mexican Peso 17.20 |

CAD Canadian Dollar 1.36 |

Enjoying This Issue?

Support Flightline and independent aviation journalism with a small contribution to help cover the costs of producing issues like this.

Thank you for being part of the Flightline community.

Daily Passenger Counts at U.S. Airports, 2026 vs. 2025

✈ A Note of Thanks

Flightline is written for readers who care deeply about commercial aviation, from routes and fleets

to security, policy, and data. Subscriber support allows this publication to remain independent,

focused, and free of advertising influence.

If you find Flightline valuable, sharing it with a colleague or fellow aviation enthusiast is the

simplest way to help it grow responsibly.

🔗 Follow Flightline

Bluesky | Instagram | Facebook | X | Flightline.news

Have a news tip to share? Send anonymously via Signal to Flightline.47

Visit the World Record Spotters Logbook

Visit the World Record Spotters Logbook