Consider upgrading as a great gift for yourself or the aviation fan in your life this holiday season.

Subscribers receive ad free access to route intelligence, airline fleet updates, data, statistics, and in-depth analysis in one publication, delivered twice each week.

Full access starts immediately. Plans are just $5 per month or $45 per year. The next issue is already in production.

Upgrade to Flightline

New and Proposed Routes ➕

Virgin Australia (VA) will begin daily flights from Sydney (SYD) to Darwin (DRW) on June 22. This Boeing 737 MAX 8 route was last served by the airline three years ago.

Delta Air Lines (DL) will resume daily flights from Boston (BOS) to Tel Aviv, Israel (TLV) on October 24. This route will be operated by Airbus A330-900neo equipment.

Oman Air (WY) is adding a 4x weekly sector from Muscat (MCT) to Singapore (SIN) on July 2. This route will be operated by Boeing 737 MAX 8 equipment.

Royal Air Maroc (AT) is adding a handful of new routes from Casablanca (CMN) next year:

Alicante, Spain (ALC), 3x weekly from April 1.

Bilbao, Spain (BIO), 3x weekly from April 1.

Verona, Italy (VRN), 3x weekly from June 20.

Lille, France (LIL), 2x weekly from July 3.

Beirut, Lebanon (BEY), 3x weekly from April 3.

Air Europa (UX) will add a 3x weekly run from Madrid (MAD) to Tangier, Morocco (TNG) on June 17. This route will see a Boeing 737 MAX 8 rostered.

Lufthansa (LH) will begin daily flights from Munich (MUC) to Istanbul (IST) on March 29. Look for an Airbus A320neo or A321neo on this route. Additionally, Lufthansa will return after a four-year hiatus to the Frankfurt (FRA) to Rzeszow, Poland (RZE) route with a 2x daily Canadair CRJ-900 on March 28.

Air Baltic (BT) has added three new routes to their schedule:

Riga, Latvia (RIX) to Warsaw, Poland (WAW), 3x weekly from March 30.

Vilnius, Lithuania (VNO) to Zurich, Switzerland (ZRH), 3x weekly from May 3.

Tallinn, Estonia (TLL), Oslo, Norway (OSL), 2x weekly from March 29.

Click the Ad below and help us pay for our server!

Run ads IRL with AdQuick

With AdQuick, you can now easily plan, deploy and measure campaigns just as easily as digital ads, making them a no-brainer to add to your team’s toolbox.

You can learn more at www.AdQuick.com

Seasonal Routes ☀️

ITA Airways (AZ) is adding 5x weekly summer seasonal service from Rome (FCO) to Marseille, France (MRS) on June 1, with flights concluding on October 24.

Air Baltic has scheduled a pair of summer seasonal routes for next year:

Riga, Latvia to Gothenburg, Sweden (GOT), 2x weekly from April 13 through October 23.

Vilnius, Lithuania to Chisinau, Moldova (KIV), 2x weekly from April 1 through October 24.

KLM Royal Dutch Airlines (KL) has added a trio of summer seasonal routes from Amsterdam (AMS) next year, all of which conclude on October 24. Each route will be flown by a mixture of Embraer E175 and E190 equipment.

Jersey, Channel Islands (JER), Daily from April 4. KLM last flew this route in 1997.

Santiago de Compostela, Spain (SCQ), 2x weekly from March 29 and daily from July 4.

Asturias / Oviedo, Spain (OVD), Daily from March 29.

Lufthansa has added several summer seasonal routes to its schedule from Munich next year:

Bastia, France (BIA), 2x weekly from April 4.

Bordeaux, France (BOD), 3x weekly from March 28.

Faro, Portugal (FAO), 2x weekly from May 3.

Lamezia Terme, Italy (SUF), 3x weekly from April 4.

Nantes, France (NTE), 2x weekly from March 29 (Approx.).

Thessaloniki, Greece (SKG), Daily (7x weekly) from March 29 (Approx.).

Valencia, Spain (VLC), 6x weekly from March 29 (Approx.).

Israeli carrier Sun d’Or (LY) will start a 3x weekly run from Tel Aviv to Naples, Italy (NAP) on March 30. A Boeing 737 will handle the workload.

Charter Routes

Smartwings (QS) has added over a dozen charter routes next summer from Tenerife Norte, Spain (TFN). Aeroroutes has the full list.

Latest Aircraft Deliveries

🇲🇹 9H-WMN, an Airbus A321-271neo, was delivered to Wizz Air Malta (W4) on December 16. Sister-ship 9H-WMP followed yesterday.

🇸🇬 9V-THJ, an Embraer E190/E2, was delivered to Scoot (TR) on December 15.

🇨🇳 B-227T, a Boeing 787-9, was delivered to China Eastern Airlines (MU) on December 16.

🇨🇳 B-32PV, an Airbus A320-251neo, was delivered to West Air (PN) on December 17.

🇨🇳 B-32Q5, an Airbus A320-271neo, was delivered to Sichuan Airlines (3U) on December 17.

🇨🇳 B-65A5 and B-65A6, a pair of Comac ARJ21-700s, were delivered to China Express Airlines (G5) on December 16.

🇨🇦 C-GRWS, a Boeing 737 MAX 8, was delivered to WestJet (WS) on December 16.

🇬🇧 G-RYMA, a Boeing 737 MAX 8, was delivered to Ryanair UK (RK) on December 11.

🇹🇭 HS-VZC, a Boeing 737 MAX 8, was delivered to VietJetAir Thailand (VZ) on December 15. Sister-ship HS-VZF followed on December 17.

🇺🇸 N246FE, a Boeing 767-300/F, was delivered to FedEx (FX) on December 16.

🇺🇸 N305NY, an Airbus A321-253neo XLR, was delivered to American Airlines (AA) on December 17.

🇺🇸 N531DN, an Airbus A350-941, was delivered to Delta Air Lines on December 17. Painted in Team USA livery.

🇺🇸 N635SY, an Embraer E175, was delivered to SkyWest Airlines (OO) on December 15. Painted in United Express livery.

🇲🇽 N815AM, a Boeing 787-9, was delivered to AeroMexico (AM) on December 16.

🇺🇸 N8985Q, a Boeing 737 MAX 8, was delivered to Southwest Airlines (WN) on December 16.

🇧🇷 PR-GKA and PR-GKB, a pair of Boeing 737-8H4s, were delivered to Gol (G3) on December 16. The hardcore avgeeks will recognize those H4 Boeing customer codes and realize that GKA was previously with Southwest as N8616C while GKB was N8617E.

🇧🇷 PS-ADL, an Embraer E195-E2, was delivered to Azul (AD) on December 12.

🇹🇷 TC-LHH, an Airbus A350-941, was delivered to Turkish Airlines (TK) on December 15.

🇦🇺 VH-E2B, an Embraer E190/E2, was delivered to Virgin Australia Regional on December 15.

🇦🇺 VH-X4J, an Airbus A320-300, was delivered to National Jet Systems (NC) on December 17. Painted in QantasLink livery.

🇻🇳 VN-A552, an Airbus A321-271neo, was delivered to VietJetAir (VJ) on December 16.

🇮🇳 VT-IOK, an Airbus A320-251neo, was delivered to IndiGo (6E) on December 15.

🇮🇳 VT-NHQ, an Airbus A321-251neo, was delivered to IndiGo on December 16.

Latest Aircraft Retirements

🇧🇴 CP-2018, a Boeing 737-73A with Boliviana de Aviacion (OB), was withdrawn from use (wfu) and ferried on December 12 to Coolidge, Ariz. (P08) for part-out and scrap.

🇨🇭 HB-JVN and HB-JVM, a pair of Embraer E190s with Helvetic Airways (2L), were wfu and ferried on November 14 and 15 to Bydgoszcz, Poland (BZG) for part-out and scrap.

🇺🇸 N428UA, an Airbus A320-232 with United Airlines, was wfu and ferried on December 16 to Victorville, Calif. (VCV) for part-out and scrap. This frame delivered new to United in May 1995 and had 92,877 hours and 37,087 cycles as of May 13.

🇺🇸 N873UA, an Airbus A319-132 with United Airlines, was wfu and ferried on December 15 to Victorville, Calif. for part-out and scrap. This frame was delivered new to China Southern Airlines (CZ) as B-6020 in September 2003. It joined United in May 2020 and had 58,997 hours and 36,438 cycles as of November 29.

A Vermont school superintendent is suing the U.S. Department of Homeland Security (DHS) after being detained at Houston Intercontinental (IAH) and subjected to warrantless searches of his personal and work electronic devices by Customs and Border Protection (CBP) agents. Wilmer Chavarria, a naturalized citizen, challenged the searches under a 2018 CBP directive that allows warrantless and suspicionless digital device searches within a broad “border zone” stretching 100 miles inland, a policy critics say effectively strips Fourth Amendment protections from millions of Americans. Chavarria initially refused to disclose passwords to protect confidential student data, but after hours of detention and assurances the data wouldn’t be accessed he complied, only to have agents search his devices out of his presence without explanation. Represented by the Pacific Legal Foundation, the lawsuit argues these warrantless searches violate the constitutional prohibition on unreasonable searches and seizures and seeks to curb expansive border search authority.

President Trump announced a major expansion of the U.S. travel ban, dramatically increasing the number of countries whose citizens face full or partial restrictions on entering the United States. The updated proclamation, set to take effect January 1, 2026, doubles the list from 19 to 39 nations and adds full entry bans for Burkina Faso, Mali, Niger, South Sudan, and Syria, along with travel document restrictions for individuals holding Palestinian Authority passports. Several countries that previously faced only partial limits, such as Laos and Sierra Leone, now face full bans, while partial restrictions are being imposed on others including Angola, Antigua and Barbuda, Benin, Côte d’Ivoire, Dominica, Gabon, The Gambia, Malawi, Mauritania, Nigeria, Senegal, Tanzania, Tonga, Zambia, and Zimbabwe. The administration cited national security and vetting concerns as justification for the expanded restrictions.

NOT AGAIN: Chaos erupted aboard an Alaska Airlines (AS) from Deadhorse, Alaska (SCC) to Anchorage (ANC) on December 10 after a passenger began hallucinating and attempted to open a mid cabin emergency exit at cruising altitude. Witnesses initially believed the man was experiencing a medical episode, but the situation escalated as he shouted about the aircraft’s wings disappearing and claimed meth fumes were entering the cabin. Another passenger intervened as the individual allegedly lifted the door handle from its fully locked position, prompting several travelers to restrain him until landing. The captain later confirmed the door could not have been opened due to cabin pressurization, though flight attendants feared the emergency slide could have deployed inside the aircraft. The passenger has since been charged with interference with flight crew members and faces up to 20 years in federal prison if convicted, although that length of sentence is highly unlikely.

Air Baltic flew 402,400 passengers in November, a slight one percent boost from one year ago. This was the most passengers the airline has ever flown in November, and they were spread across 3,766 flights during the month. System-wide load factor last month was 78.3 percent.

Singapore Airlines (SQ) welcomed 3,527,800 passengers in November, filling 87.3 percent of its available revenue seats during the month.

LATAM (LA) transported nearly 7.4 million passengers last month, which was up just under five percent from November 2024. LATAM filled 85.4 percent of its revenue seats during the month. For the first 11 months of the year the airline has flown 79.6 million passengers.

WestJet (WS) has paused plans to roll out non-reclining economy seats across much of its Boeing 737 fleet after strong backlash from passengers, unions, and employees over comfort and accessibility concerns. The airline will limit the configuration to 22 aircraft for now, down from an initially planned 43, while it gathers further customer and operational feedback during the busy holiday travel period. WestJet said it may revisit the denser cabin concept in spring 2026, highlighting the ongoing tension between cost efficiency, ancillary revenue strategies, and passenger experience in the commercial aviation industry.

The Federal Aviation Administration (FAA) has committed $108 million to Austin, Texas (AUS) to fund major airfield improvements, including new taxiways, high speed exits, and infrastructure upgrades that support the planned Concourse B expansion. The new concourse is expected to add more than 20 gates along with additional passenger amenities to accommodate rapid traffic growth at Austin. The funding comes from federal grants and airport revenues, with no local taxpayer dollars involved, and is aimed at improving capacity, safety, and reducing delays as Austin continues to expand its role as a key commercial aviation market.

Norfolk, Va. (ORF) put together a presentation, flagged by IshrionA, showing the top 10 largest trans-Atlantic markets that don’t presently have nonstop service.

UPDATE: Spirit Airlines (NK) has secured crucial additional funding and debtor-in-possession financing as part of its ongoing Chapter 11 restructuring, providing the airline with the liquidity needed to maintain operations while it works through labor cost adjustments, fleet reductions, and balance sheet restructuring. The new financing round included commitments from existing and new lenders, giving stakeholders confidence that Spirit can meet immediate obligations and support strategic stability ahead of key deadlines imposed by the bankruptcy court. This infusion of capital removes a significant overhang that had raised concerns about potential service disruptions, signaling to lessors and financial markets that the carrier has the ability to continue operations and pursue a viable path forward.

Frontier Airlines (F9) CEO Barry Biffle stepped down effective immediately, ending an 11-year run at the ultra-low-cost carrier as the airline grapples with declining profitability and weak demand. Company president James Dempsey, a former CFO with prior Ryanair (FR) experience, has been named interim CEO while Biffle remains an advisor through year end. The leadership change comes after Frontier reported a sluggish third quarter (a $77 million net loss), including a negative operating margin, as domestic price sensitive demand softened and travelers shifted toward international and premium products. EDITOR’S NOTE: If you are thinking with the departure of Biffle that merger talks with Frontier and Spirit are back on, you are not alone.

South Korea’s president ignited an unusual controversy by publicly asserting that cash could be smuggled out of the country by slipping $100 bills between the pages of books carried by airline passengers, and calling for Seoul Incheon (ICN) security to manually search all bags for books to prevent this method. Airport leadership pushed back, noting (correctly) that such 100 percent manual inspections would cripple airport operations and that customs handles illegal currency seizures. The exchange quickly became political, with critics linking the president’s example to past high-profile currency smuggling cases and questioning the practicality and motive behind the directive, underscoring tension between enforcement posture and efficient airport operations.

Lobbying group Airlines For America notes that U.S. airlines will fly a record 52.6 million passengers between December 19 and January 5, an average of 2.9 million each day.

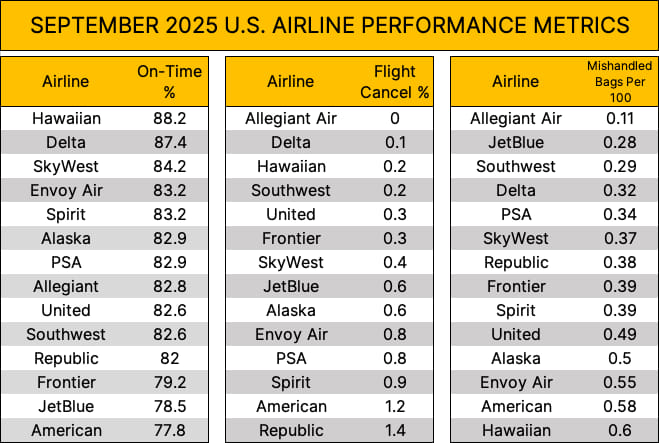

The Bureau of Transportation Statistics (BTS) has released its September 2025 report which covers a variety of U.S. airline performance metrics. Here are the top airlines for on-time performance, the lowest flight cancellation percentages, and how airlines fared handling checked baggage:

Hawaiian Airlines (HA) will join the oneworld alliance on April 22, the same day when the “HA” code disappears and Hawaiian and Alaska Airlines begin operating on a single passenger service system.

United Airlines (UA) has entered into a sale and leaseback agreement with lessor SMBC Aviation Capital. This new agreement between the two covers a tranche of some 20 Boeing 737 MAX 9s that will be delivered in 2026. United and SMBC have previously made similar agreements for 20 A321neos and 20 737 MAX 8s.

Continuing on with November’s most punctual airlines, according to Cirium, we have the numbers from Latin America and Africa:

A Cuban national living in Las Vegas made his initial court appearance Friday for attempting to access a secure passenger boarding area using a false boarding pass and assaulting officers at Las Vegas (LAS).

According to allegations contained in the indictment, on November 3, 2025, Jhon Raul Vizcaino Ramirez presented a Transportation Security Administration (TSA) screening officer a boarding pass in the name of another person and attempted to enter the passenger boarding area. Ramirez refused to provide his identification. When another screening officer refused to return the boarding pass, Ramirez slapped the officer. Officers with the Las Vegas Metropolitan Police Department who were working at the checkpoint were advised of a disturbance and responded to the scene. Officers attempted to detain Ramirez, and he resisted. During the altercation, Ramirez twice kicked an officer and kicked a Transportation Security Officer who was assisting to detain him.

Ramirez is charged with two counts of interference with security screening personnel; two counts of assault, resisting, or impeding person assisting certain officers or employees; and one count of entry by false pretenses to secure area of any airport. A jury trial has been set for February 9, 2026, before United States District Chief Judge Andrew P. Gordon.

Ramirez was originally found by U.S. Customs and Border Patrol on October 27, 2022, near Yuma, Arizona, after he illegally entered the U.S. from Mexico. Due to a lack of detention space, he was released. Ramirez has illegally remained in the U.S. since his release. Due to his most recent arrest, Immigration and Custom Enforcement (ICE), has placed a detainer on him, which means he will be turned over to ICE upon conclusion of his Federal criminal charges.

Apollo Global Management is exploring a sale of its aviation unit Atlas Air Worldwide, targeting a valuation of around $12 billion including debt, according to people familiar with the matter. The private equity firm is in early discussions and has drawn interest from other industry players and private equity groups as potential buyers. No deal is imminent, and Apollo is still weighing strategic options, but the move signals a possible exit from the air cargo and aircraft leasing business at a time when demand for freight capacity remains a key factor in aviation markets. The potential sale, if pursued, would rank among the largest transactions in the air cargo sector in recent years.

📈 Flightline Financials 🏦

|

Airline & Airport Operator Stock Prices (Previous Day Closing Price) |

|||

|

AAL American $15.51 |

AERO AeroMexico $20.98 |

ALGT Allegiant $85.49 |

ALK Alaska $51.24 |

|

BA Boeing $206.33 |

CPA Copa $118.35 |

DAL Delta $69.72 |

EMBJ Embraer $62.42 |

|

JBLU JetBlue $4.77 |

LTM LATAM $51.85 |

LUV Southwest $40.98 |

RJET Republic $19.94 |

|

RYAAY Ryanair $70.52 |

SNCY Sun Country $14.67 |

SKYW SkyWest $101.90 |

UAL United $110.27 |

|

ULCC Frontier $5.08 |

VLRS Volaris $7.95 |

OIL Per Barrel $56.91 |

|

|

ASR Asur $312.56 |

OMAB OMA $105.84 |

PAC GAP $258.00 |

CAAP Corp America $25.04 |

✈ A Note of Thanks

Flightline is written for readers who care deeply about commercial aviation, from routes and fleets

to security, policy, and data. Subscriber support allows this publication to remain independent,

focused, and free of advertising influence.

If you find Flightline valuable, sharing it with a colleague or fellow aviation enthusiast is the

simplest way to help it grow responsibly.

🔗 Follow Flightline

Bluesky | Instagram | Facebook | X | Flightline.news

Have a news tip to share? Send anonymously on Signal to Flightline.47

Visit the World Record Spotters Logbook

Visit the World Record Spotters Logbook